Quick CV Dropoff

Want to hear about the latest non-profit and public sector opportunities as soon as they become available? Upload your CV below and a member of our team will be in touch.

Our latest report below analyses data from the non-profit sector for:

The data below was obtained between October - December 2025 from non-profit specialist job boards and agencies.

Key non-profit trends this quarter:

Vacancy levels remained broadly stable in Q4, suggesting a labour market that has levelled off after a prolonged period of decline. Early ONS estimates show total vacancies at 729,000 between September and November 2025, down by just 2,000 roles (-0.2%) on the previous quarter.

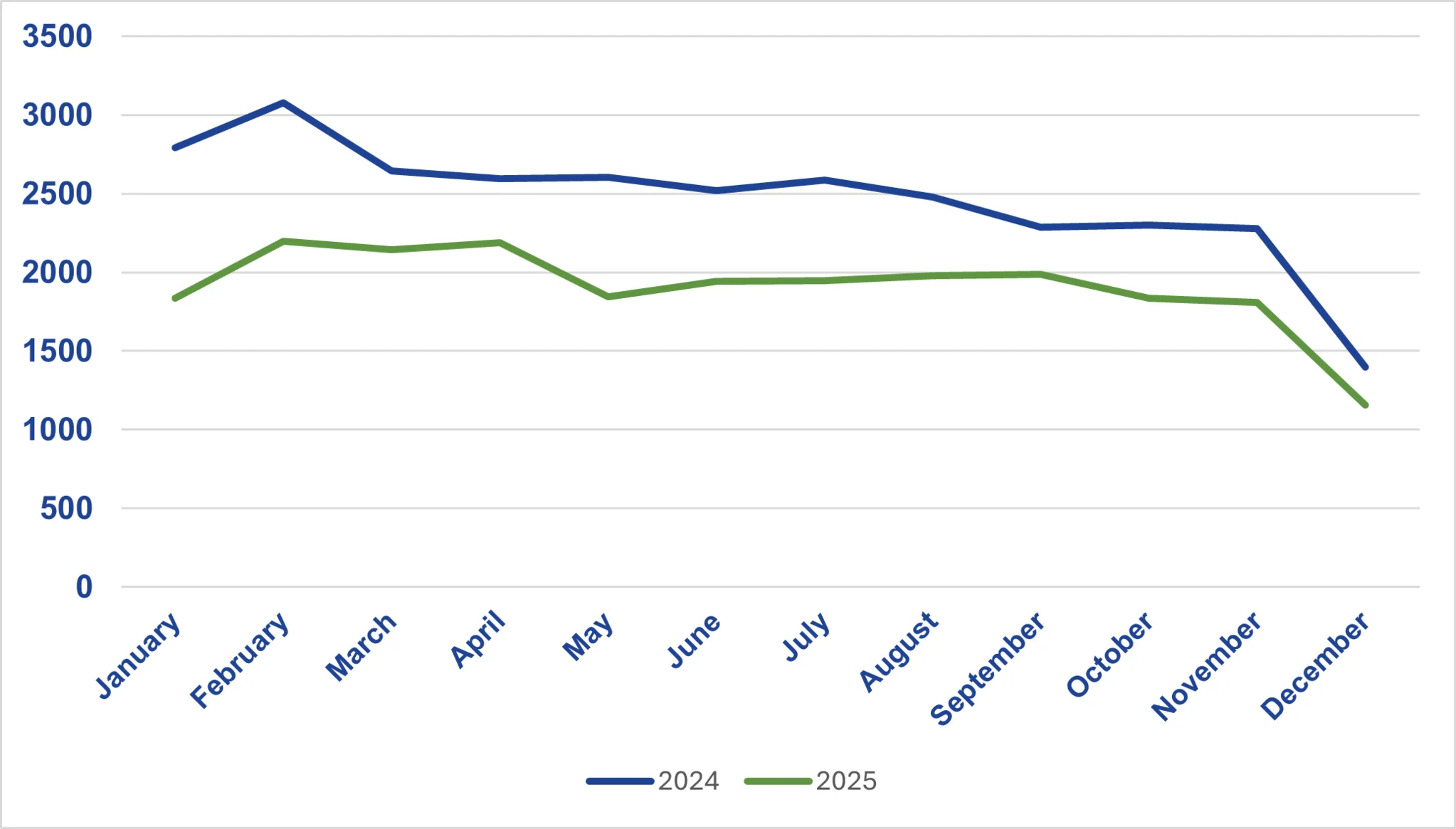

Within the non-profit sector specifically, Q4 vacancy levels fell sharply compared to Q3, but the identical decline seen in Q4 2024 indicates a consistent seasonal pattern rather than a deterioration in demand.

While vacancy numbers are down year-on-year, the flat quarter-on-quarter picture suggests a market that has stabilised rather than continued to weaken. This aligns with CIPD Labour Market Outlook data for Autumn 2025 showing sustained recruitment intentions despite low net employment growth.

This will be important as we have also seen an increase in candidate availability, indicating a gradual shift towards a more balanced job market.

*O&SS - This includes roles in administration, PA & executive support, operations, legacy support, membership, programmes, projects, research & policy, data, supporter care.

Across most job functions, live vacancies fell both quarter-on-quarter and year-on-year in Q4, consistent with year-end seasonality and a more cautious hiring environment. However it is notable that CEO and leadership roles proved comparatively resilient.

Data tracked here is for live vacancies within the non-profit sector advertised as permanent, temporary and fixed-term contract.

This quarter, the share of permanent, temporary and fixed-term contract roles advertised stayed consistent with Q3.

Hybrid working remained the dominant model in Q4, with little change quarter-on-quarter and having stayed consistently at around 50% of all jobs posted in 2025. However, the data suggests a modest shift away from fully remote roles and a slight increase in on-site vacancies, indicating a gradual re-tightening of location expectations (rather than a reversal of flexible working).

Roles advertised as entry-level in Q4 were down by 20% when compared to the previous quarter, but have remained consistently at an average of 10% of all live vacancies throughout 2025.

Although the distribution of entry-level roles has remained stable, we will continue to monitor this figure closely due to the anticipated impact that artificial intelligence and automation may have on this sector in the near future.

However, employers should be cautious about eliminating entry-level positions entirely. These roles are critical for developing future talent, bringing in fresh perspectives, and maintaining workforce sustainability. A balanced approach, combining entry-level and more experienced hires, allows organisations to remain efficient while investing in the long-term pipeline of skills and organisational knowledge.

Applications to live roles declined in Q4, while new candidate registrations increased significantly over this reporting period, suggesting growing candidate availability alongside more selective application behaviour. This pattern indicates longer decision-making cycles and may represent latent demand that could translate into increased hiring momentum as market confidence returns.

With data suggesting a market that is stabilising rather than deteriorating and increased candidate availability in Q4, there are cautious signs of optimism for employers in 2026.

Recruitment activity has not stalled, rather it has become more selective, more deliberate and more outcome-focused. Organisations that approach hiring strategically, remain open to flexible resourcing models, and invest in candidate experience are best placed to navigate the current market and build sustainable teams for the year ahead.