Quick CV Dropoff

Want to hear about the latest non-profit and public sector opportunities as soon as they become available? Upload your CV below and a member of our team will be in touch.

Our latest report below analyses data from the non-profit sector for:

The data below was obtained between July-September 2025 from non-profit specialist job boards and agencies.

Key non-profit trends this quarter:

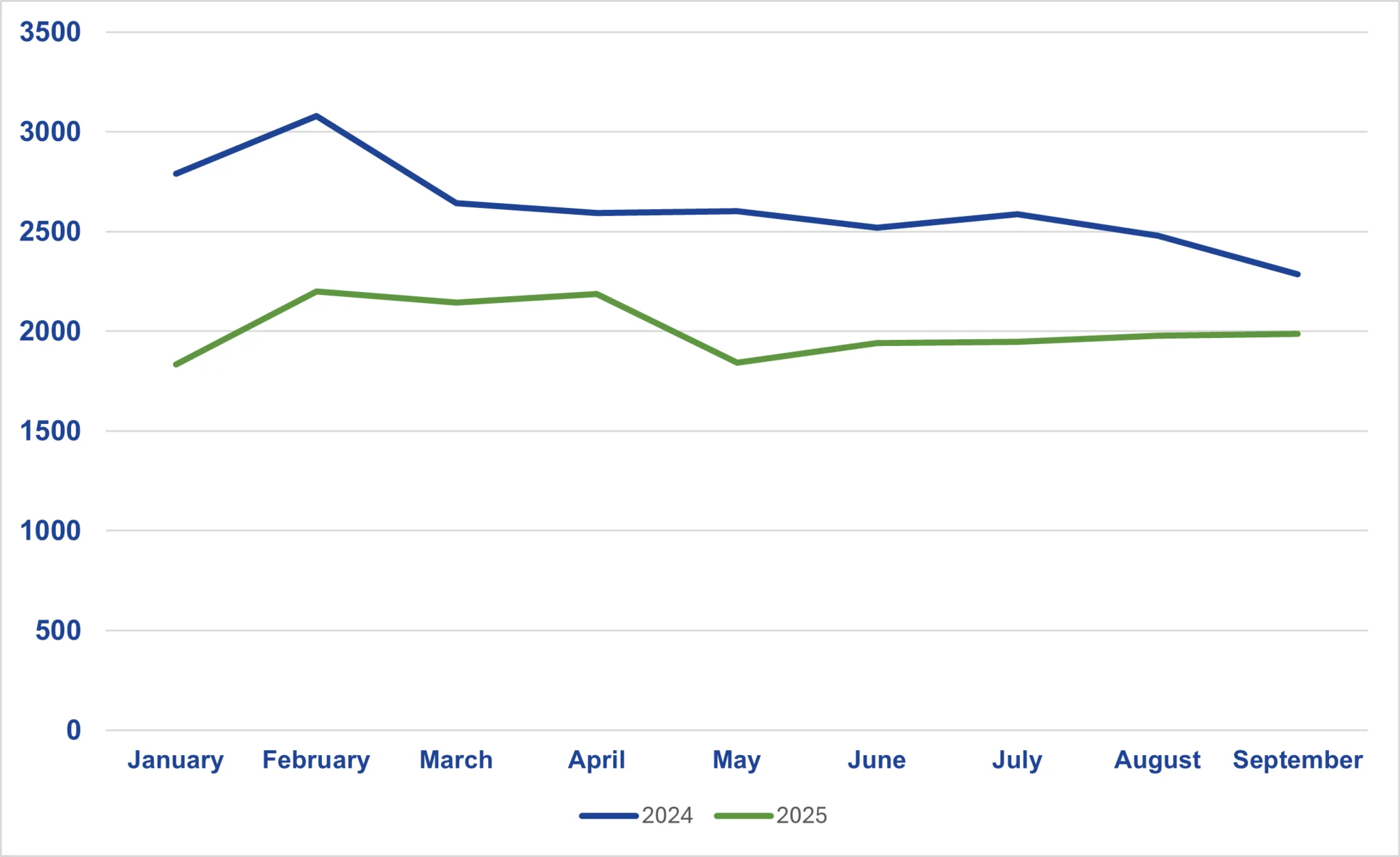

Q3 (July-September 2025) continued the trend of a cooling jobs market, with a small reduction compared to Q2 (Apr-June) - presenting a flat job market. Comparing to the same time period in 2024, both the number of vacancies and number of job applications have declined.

The ongoing reduction in vacancies is a long-term trend within the UK market seeing its 38th consecutive quarterly drop, which is also reflected in the non-profit sector, with a 20% year-on-year decline in live jobs. This decline is mirrored across most job functions, with HR, fundraising, finance, and marcomms all seeing double-digit percentage drops in both quarterly and annual comparisons.

Interestingly, comparing July-September 2025 against the same period in 2024, the fact that job numbers have remained consistent could be viewed positively, as in 2024 this period was characterised by month-on-month decline.

*O&SS - This includes roles in administration, PA & executive support, operations, legacy support, membership, programmes, projects, research & policy, data, supporter care.

All major job functions saw declines both quarter-on-quarter and year-on-year, with HR & finance seeing the biggest seasonal dips in August. There are some small but notable increases in August and September this year, bucking the trend from 2024, which will be interesting to monitor as we move into the final quarter of the year.

Data tracked here is for live vacancies within the non-profit sector advertised as permanent, temporary and fixed-term contract.

This quarter saw a slight increase to contract roles, by 2%, with the same decline in permanent vacancies, whilst temporary roles remained steady.

Hybrid roles remain dominant (50.4%), with a slight uptick in on-site roles, after a drop earlier in the year.

Organisations are downsizing office footprints, relocating and embracing remote-friendly models to attract talent with in-demand skills. However, although location flexibility is clearly being prioritised, the structure of working hours remains largely unchanged. The static proportion of part-time roles suggests that many organisations have yet to fully explore flexible job design as a tool for inclusion.

On average 10% of live vacancies were advertised as entry-level between July-September 2025 within the non-profit sector.

This has remained at this level consistently since last year. It may reflect reduced organisational headcount and limited capacity to train and support junior staff. With many teams stretched, hiring decisions are increasingly focused on immediate skill needs. Additionally, the growing influence of AI and automation on administrative and support functions may be reshaping the scope of entry-level roles.

This presents both a challenge and an opportunity for organisations. Investing in entry-level talent is a key lever for long-term workforce sustainability. By adapting role structures, such as offering part-time or flexibility, organisations can tap into underutilised talent pools and build resilience within teams. Strategic entry-level hiring can help plug resource gaps while nurturing the next generation of sector professionals.

Although the market remains candidate-driven, the average response rate in Q3 has dropped by 23%. This could be due to seasonal factors, but there is still a significant drop YoY, by 10%. Candidates are increasingly selective, prioritising roles that offer flexibility, and visible organisational values.

Notably, there was a decline in candidate availability amongst permanent candidates, compared to Q2 2025, by 8%, again this shift may be due to seasonal factors, where typically movement is often around more urgent temporary needs.

While Q3 2025 has been another challenging quarter, there are signs of cautious optimism. Month-on-month job postings haven't declined like we saw in 2024.

Key pain points

The non-profit sector faces ongoing recruitment and retention challenges, but there are signs of resilience and adaptation. HR professionals are at the forefront of this, balancing cost pressures, evolving candidate expectations, and the need for organisational agility.

As we enter the final quarter of 2025, the sector will be watching closely to see how the Autumn Budget shapes the economic landscape and whether it provides the confidence boost needed to reignite hiring momentum. By focusing on wellbeing, internal mobility, and inclusive job design, non-profits can position themselves for sustainable growth in the year ahead.