Quick CV Dropoff

Want to hear about the latest non-profit and public sector opportunities as soon as they become available? Upload your CV below and a member of our team will be in touch.

Our latest report below analyses data from the non-profit sector for:

The data below was obtained between April-June 2025 from non-profit specialist job boards and agencies.

While the UK employment rate has risen slightly to 75.1%, hiring activity across the non-profit sector remains cautious, with many organisations still hesitant to replace leavers or expand teams.

Despite this, there are early signs of a potential recovery. Most job functions saw a modest month-on-month increase in live roles, suggesting that some employers may be regaining confidence following the new financial year and changes to employer costs.

Key non-profit trends this quarter:

The UK labour market continues to show signs of strain, with ONS data showing another drop in vacancies between March and May 2025, by 63,000 to 736,000 vacancies – now below pre-pandemic levels (Jan–Mar 2020).

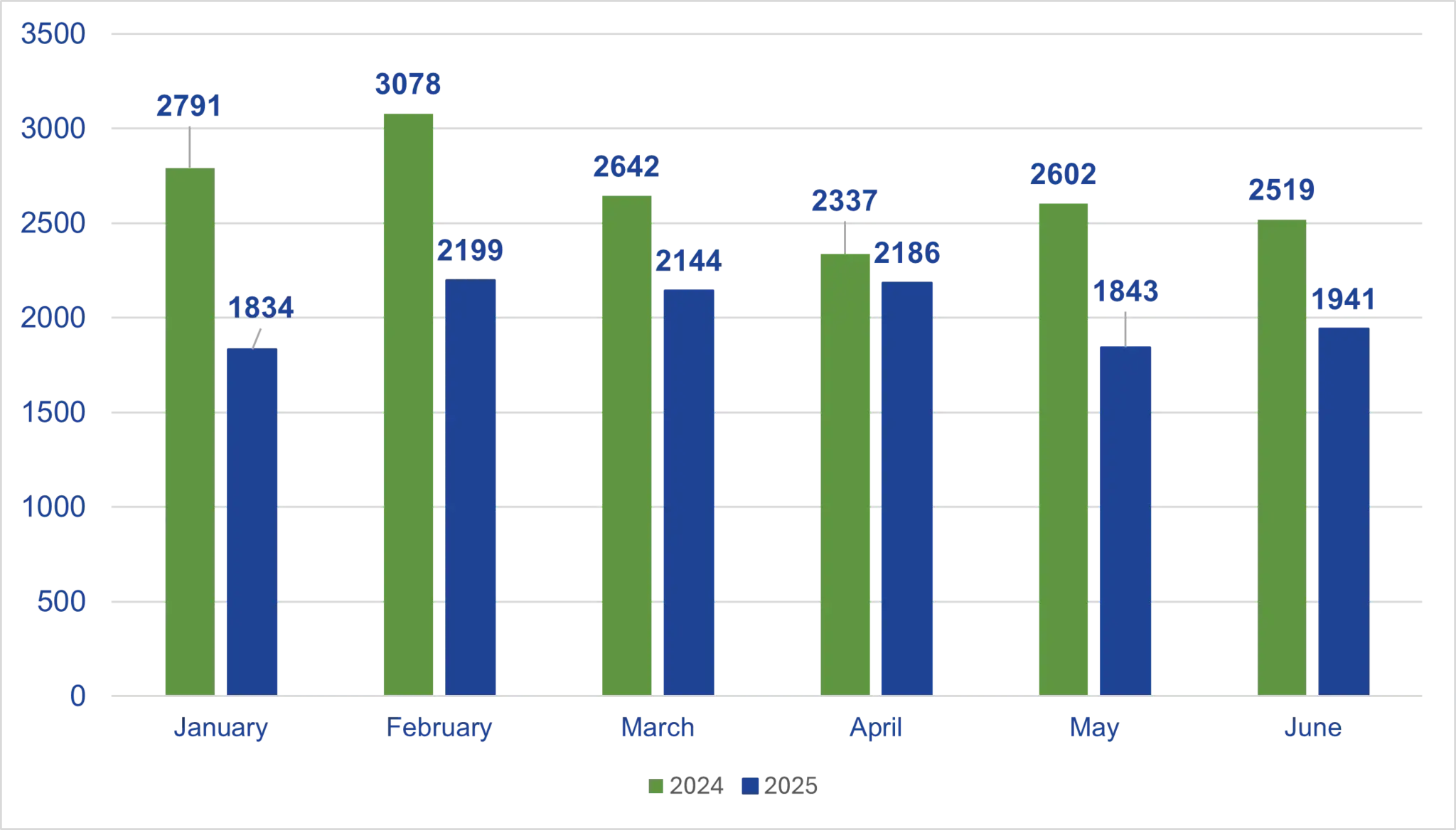

Compared to April-June 2024, live vacancies within non-profit organisations have dropped by 29%. However vacancy levels from April-June 2025 are now back to levels seen at the end of 2024, indicating some job recovery and perhaps indicating some renewed confidence.

The largest dip was in May-June just after the employer cost changes to NI came into force and a new financial year. The May downturn could be linked to the impact of school holidays and bank holidays and delayed budget approvals post-financial year-end

*O&SS - This includes roles in administration, PA & executive support, operations, legacy support, membership, programmes, projects, research & policy, data, supporter care.

Across the 2024/25 period, most job functions (excluding CEO roles) have followed a trend with a marked decrease Jan-Dec 2024, followed by a weak recovery into 2025 that is impacting functions at different rates. The increase in June is encouraging and could be indicative of renewed confidence in the sector, reflecting economic conditions stabilising and a strategic shift by organisations to bolster teams ahead of the summer period. It also suggests a response to operational pressures, with many departments likely experiencing strain due to being under-resourced, prompting organisations to act on long-delayed hiring plans.

Data tracked here is for live vacancies within the non-profit sector advertised as permanent, temporary and fixed-term contract.

This quarter saw permanent, temporary and contract vacancies remain fairly similar to January to March 2025, with a very small uplift in permanent roles (1%).

There has been a slight increase in remote vacancies and a slight decrease in on-site vacancies this quarter, with hybrid remaining the same.

Over the last year, the data reveals a (near) sustained decline in on-site roles alongside a modest rise in remote opportunities, while hybrid working has clearly cemented itself as the new standard. This shift likely reflects broader sector trends, including cost-saving measures such as downsizing office space, movement away from prime city locations and a growing openness to remote arrangements to attract talent with in-demand skills. Despite economic pressures, organisations appear to be prioritising flexibility via location, more than flexible hours, as the lack of change in part-time roles suggests there’s still untapped potential in rethinking how roles are structured to widen access to diverse talent pools.

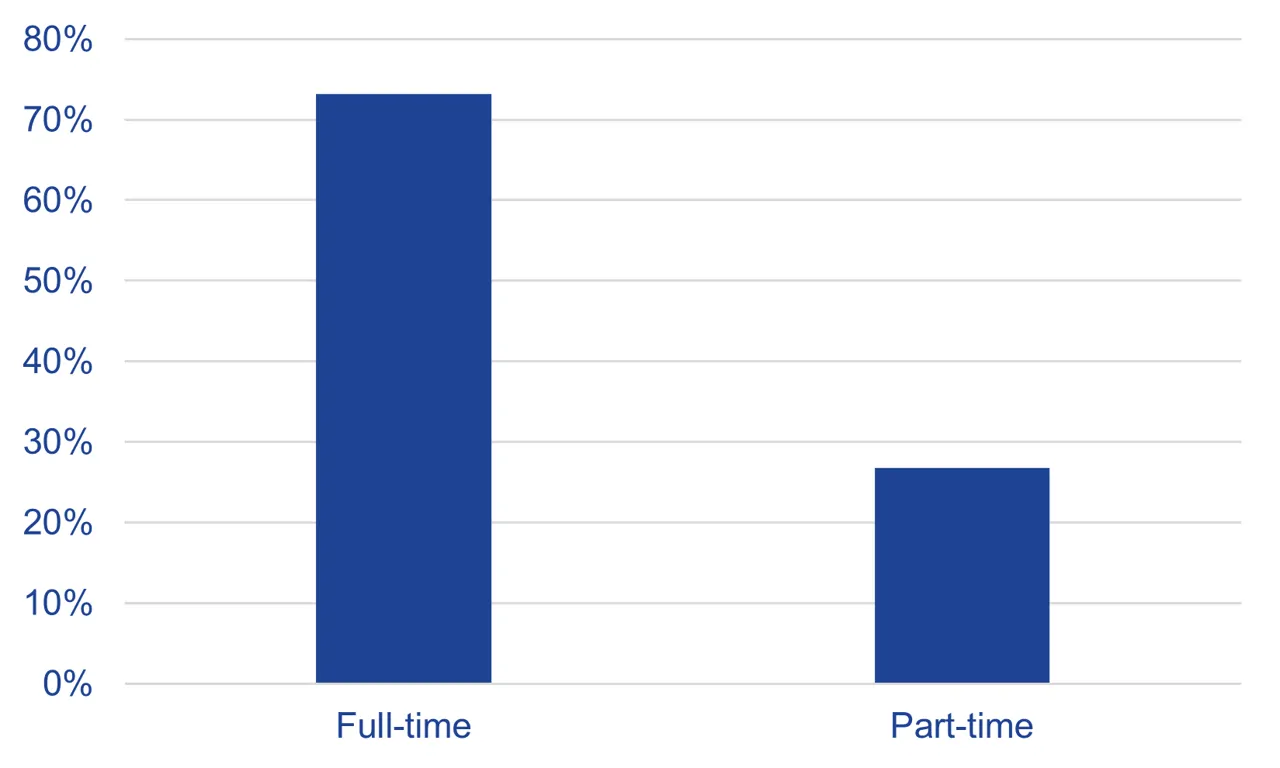

The number of live vacancies advertised as full-time and part-time has continued to remain consistent, with no change in the last quarter or YoY.

Despite ongoing discussions around flexible working and the financial pressures facing many non-profits, the proportion of part-time roles has remained unchanged at 27%. This lack of movement suggests a missed opportunity for innovation in role design. By not increasing part-time offerings, organisations may be inadvertently limiting access to valuable talent pools, including parents, carers, and disabled professionals.

In a competitive hiring landscape and with candidate expectations evolving, rethinking job structures to include more part-time options could be a strategic lever for attracting and retaining a diverse workforce with the right skills.

The average number of vacancies advertised as entry-level between April-June 2025 was 10% of live vacancies, with an 18% drop on last quarter in terms of entry level jobs posted, (biggest drop being in June 2025.)

This may be linked to reduced headcount within organisations and a lack of training capacity and or resource available to support these people. When organisations are hiring there is more of a focus on needed skills needed there and then, additionally, the growing influence of AI and automation on early career roles could impact entry level roles.

Opportunities exist for non-profit organisations to future-proof the workforce through entry-level roles and organisations should consider where they can adapt here, such as flexible working (part-time roles) to plug resource gaps within teams.

The average response rate in Q2 is back in line with application numbers we saw in Q4 2024 and marginally up YoY by 4%. The TPP website saw a significant increase in average responses (15%), indicating a stronger engagement with the TPP platform.

Notably, there was a decline in candidate availability amongst permanent candidates, compared to Q4 2024, but a uplift in temporary candidate availability by 24%.

This drop may reflect:

While Q2 2025 has been another challenging quarter, there are signs of cautious optimism. Month-on-month increases in job postings across most job functions suggest that the market may be stabilising. As we move into Q3, we’ll be watching closely to see whether this trend continues and how organisations adapt their hiring strategies.