Quick CV Dropoff

Want to hear about the latest non-profit and public sector opportunities as soon as they become available? Upload your CV below and a member of our team will be in touch.

Our latest report below analyses data from the non-profit sector for:

- The number of live permanent, temporary and fixed-term contract vacancies

- Availability of hybrid and remote working roles

- Key job discipline hiring, including; fundraising, finance, marcomms, HR & CEO

- The data below was obtained between January - March 2025 from non-profit specialist job boards and agencies.

The labour market remains tight, with an estimated 781,000 vacancies from January to March 2025. This was a decrease of 26,000 on the previous quarter and the first time since March to May 2021 they were below the pre-coronavirus (COVID-19) pandemic figure.

The employment rate for people aged 16 to 64 years stands at 75.1% for December 2024 to February 2025, reflecting an improvement from the previous year and a rise in the latest quarter.

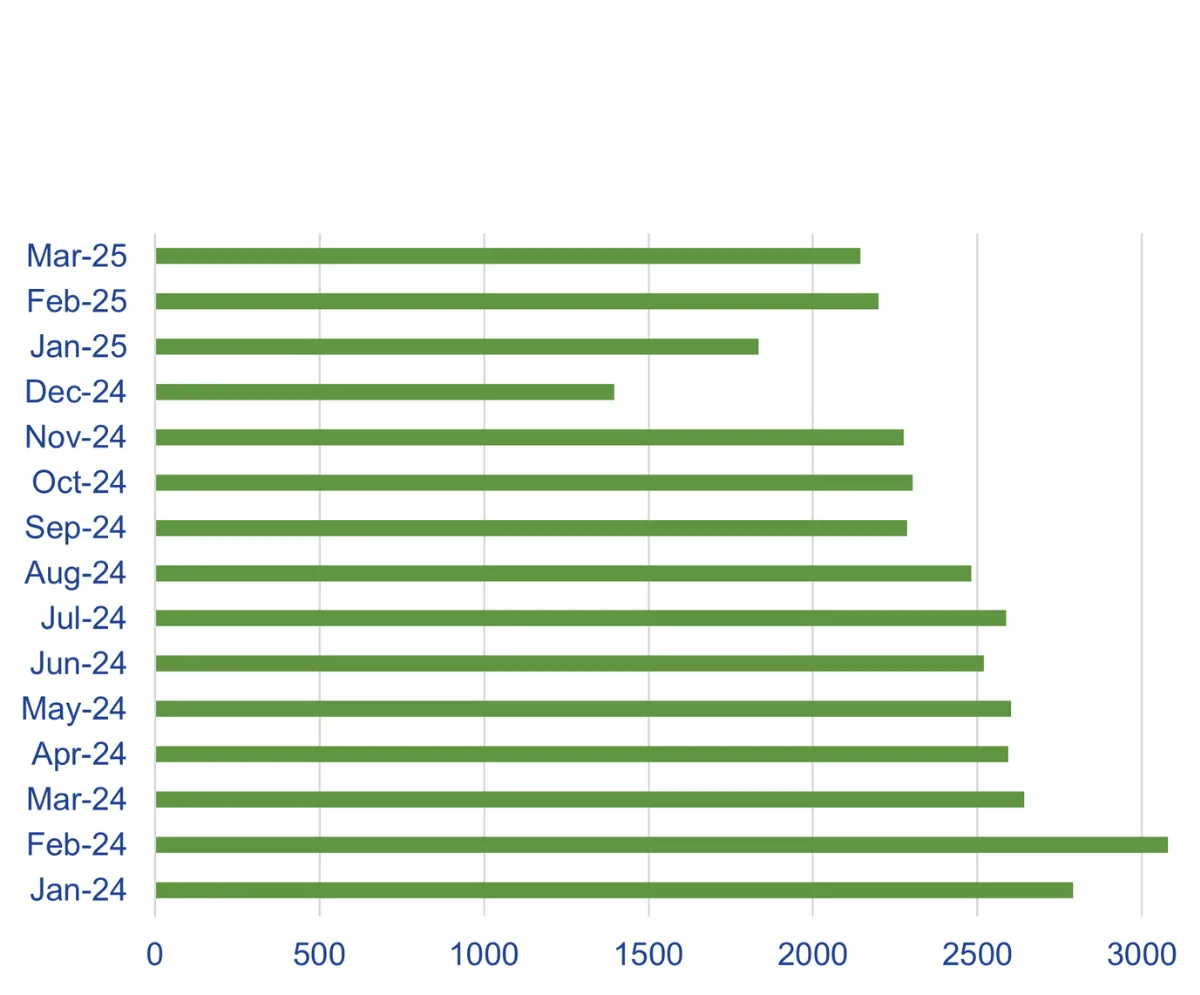

Compared to January-March 2024, live vacancies within non-profit organisations have dropped by 40%. This is a considerable decline in vacancy numbers at a time of year that is typically busy on both the employer and job seeker front. Organisations picking up on recruitment that may have been put on hold or stalled over the festive period and job seekers actively exploring new opportunities to kick off a fresh new year.

Although the start of 2025 saw the expected rise in job vacancies (following the seasonal drop in December), vacancies are still below the level seen in November 2024. This is unusual, as January and February are typically two of the busiest months in terms of live vacancies.

*O&SS - This includes roles in administration, PA & executive support, operations, legacy support, membership, programmes, projects, research & policy, data, supporter care.

Non-profit organisations across the UK are still grappling with rising costs due to the ongoing uncertainty and challenging economic conditions. The recent increase in employer National Insurance contributions has certainly not helped. Additionally, the rise in National Minimum Wage for workers over 21 has further intensified finance pressures.

This financial strain is compounded by the growing demand for their vital services. Non-profits are facing tough decisions, often resorting to cost-saving measures such as organisational restructures and service reductions. Increased workload, the need for resources and capability to keep up with technological advancements, and ongoing skills shortages are adding to the pressure.

Data tracked here is for live vacancies within the non-profit sector advertised as permanent, temporary and fixed-term contract.

This quarter saw permanent, temporary and contract vacancies remain at the same levels as October to December 2024.

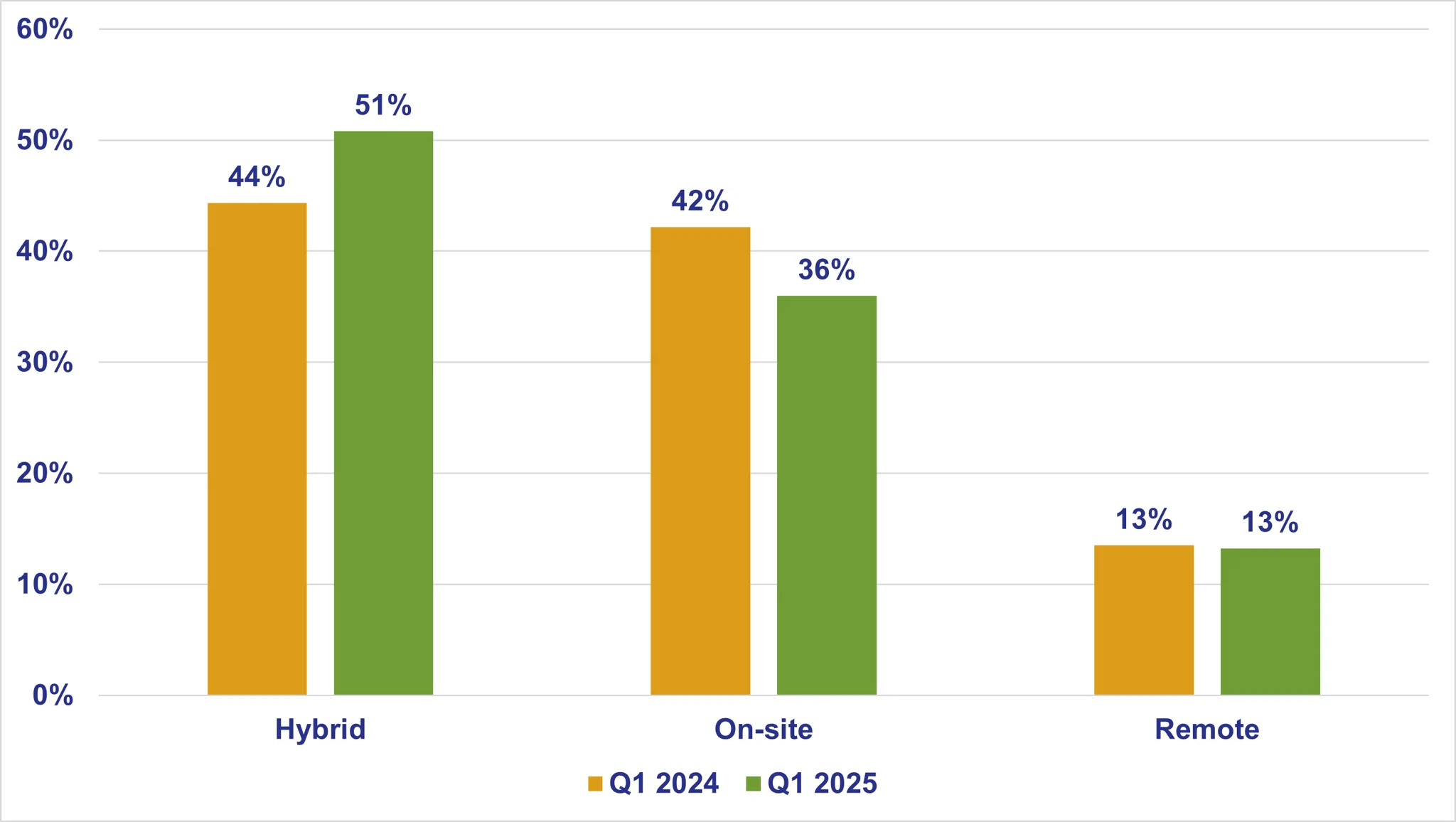

Whilst there has been a slight increase in hybrid vacancies and a slight decrease in on-site vacancies this quarter, levels have largely remained the same.

However, YoY there have been more hybrid roles, with an average of 44% in Q1 2024, now at 51%, and a decline in on-site which was 42% in Q1 2024, now, 36%.

This may be indicative of hybrid working arrangements being far more embedded, with organisations making adjustments to suit candidate preferences and requirements around flexible working. Candidates are increasingly more open to, and willing to consider some office working.

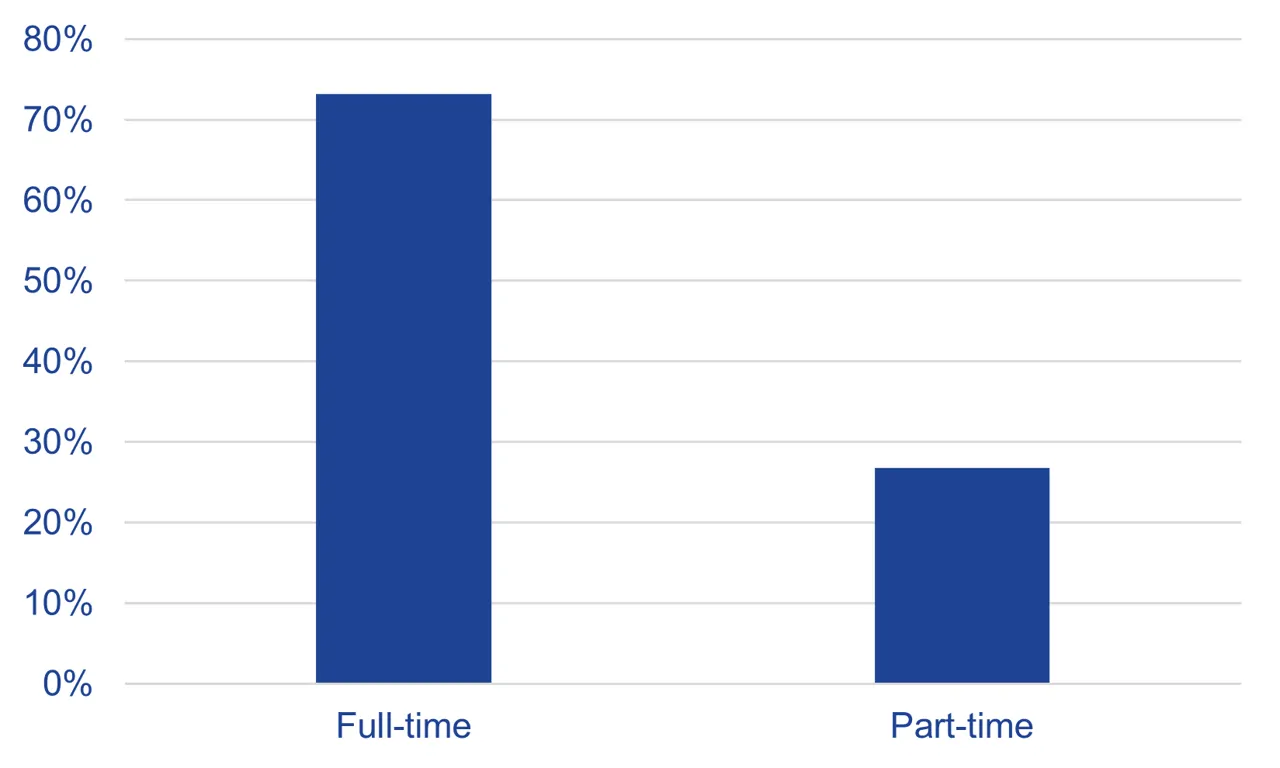

The number of live vacancies advertised as full-time and part-time has continued to remain consistent, with no change in the last quarter regardless of market conditions.

The average number of vacancies advertised as entry-level in Q1 was 10% of live vacancies, this compares to an average of 11% during 2024.

With little indication of change in attracting more entry level talent into the non-profit sector, the sector will continue to struggle with acquiring new and future-fit skills needed.

Engaging the younger generation is vital for ensuring the sustainability and growth of the sector. Without a steady influx of young professionals who are then supported and developed within their roles, organisations will struggle to innovate and adapt to technological advancements.

While our focus on entry-level roles often highlights the younger generation, it's important to recognise that these positions also attract individuals at the later stages of their careers who are making deliberate choices to start anew. This shift, though not as prominent, contributes to a broader diversity of thought and experience at the entry level, enriching the sector's capacity for innovation and adaptability.

Organisations are facing an increasing challenge of managing high volume applications, a task made even more complex by stretched capacity and the growing use of AI by job seekers, the pressure to efficiently screen, vet, and interview candidates is mounting.

The average response rate in Q1 was 106 applications per job, a significant increase from 73 in Q4 last year, representing a 45% rise. Additionally, there was a 23% increase in permanent candidate availability and an 18% increase in fixed-term contract (FTC) candidate availability in Q1 compared to Q4 2024. However, there was no change in temporary candidate availability.

The rise in AI generated applications adds another layer of complexity as these tools can produce polished and tailored CVs and applications at scale. This requires more thorough screening processes to ensure authenticity and suitability for the role and organisation. Employers must invest in robust screening, vetting mechanisms and comprehensive interviewing techniques to navigate this influx effectively.